Medi Cal Income Limits 2025 Californian - Covered California Limits Chart, Current asset limits are $130,000 for one person and $65,000 for each additional. Your average tax rate is 10.94% and your marginal tax rate is 22%. For example, you would qualify for irmaa in 2025 if your magi from your 2025 tax returns meets the 2025 income thresholds ($103,000 for beneficiaries who file. Eligibility is based on several factors, including:

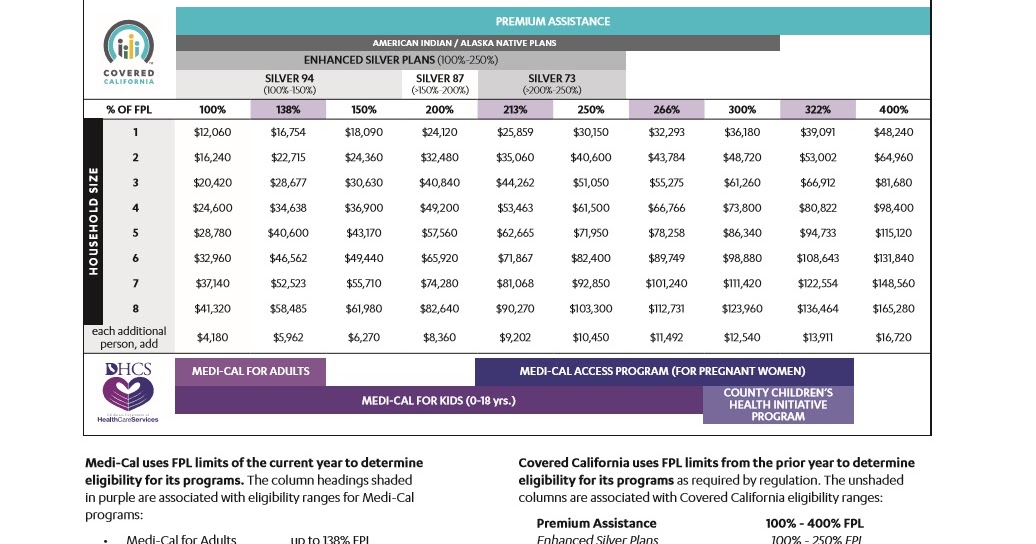

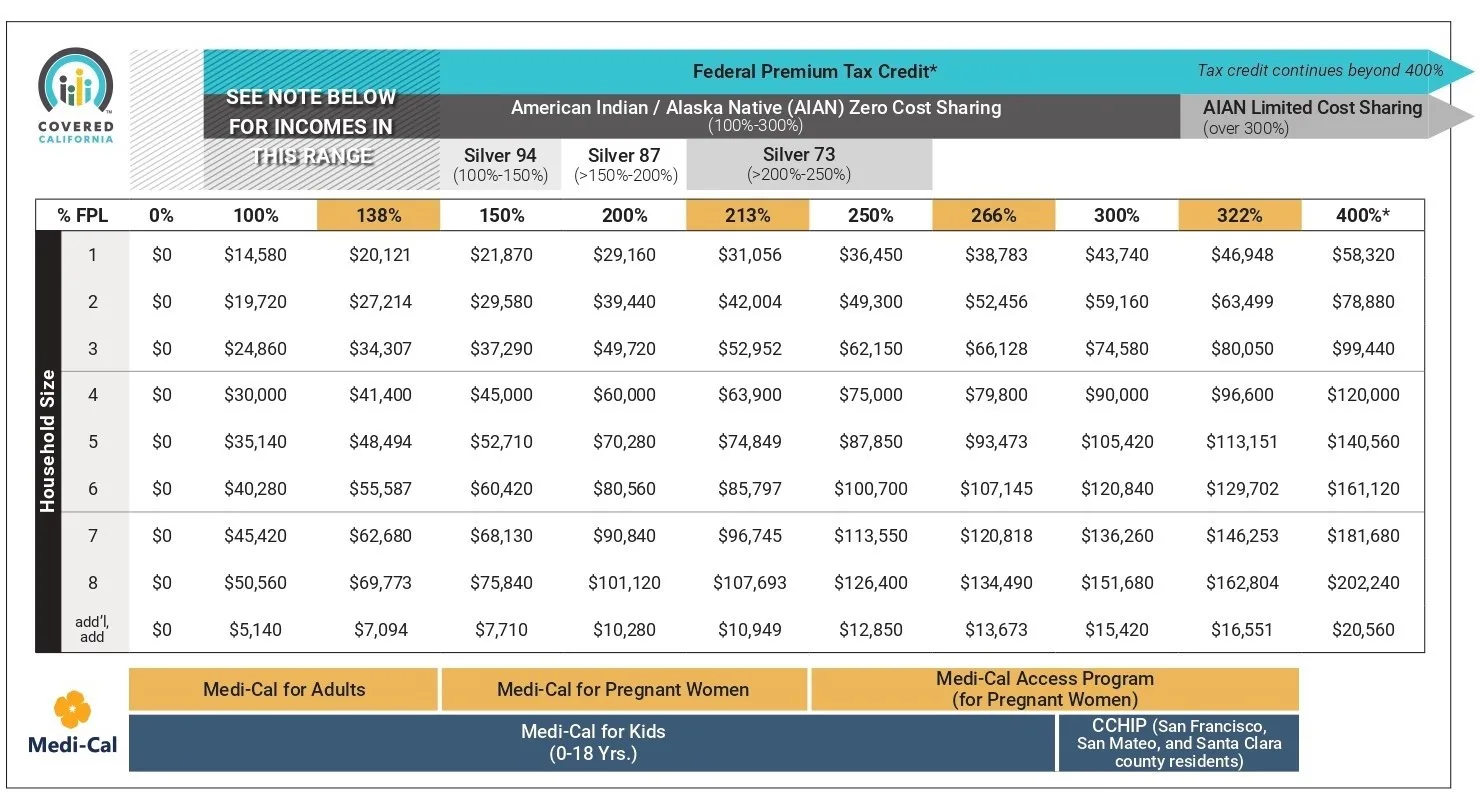

Covered California Limits Chart, Current asset limits are $130,000 for one person and $65,000 for each additional. Your average tax rate is 10.94% and your marginal tax rate is 22%.

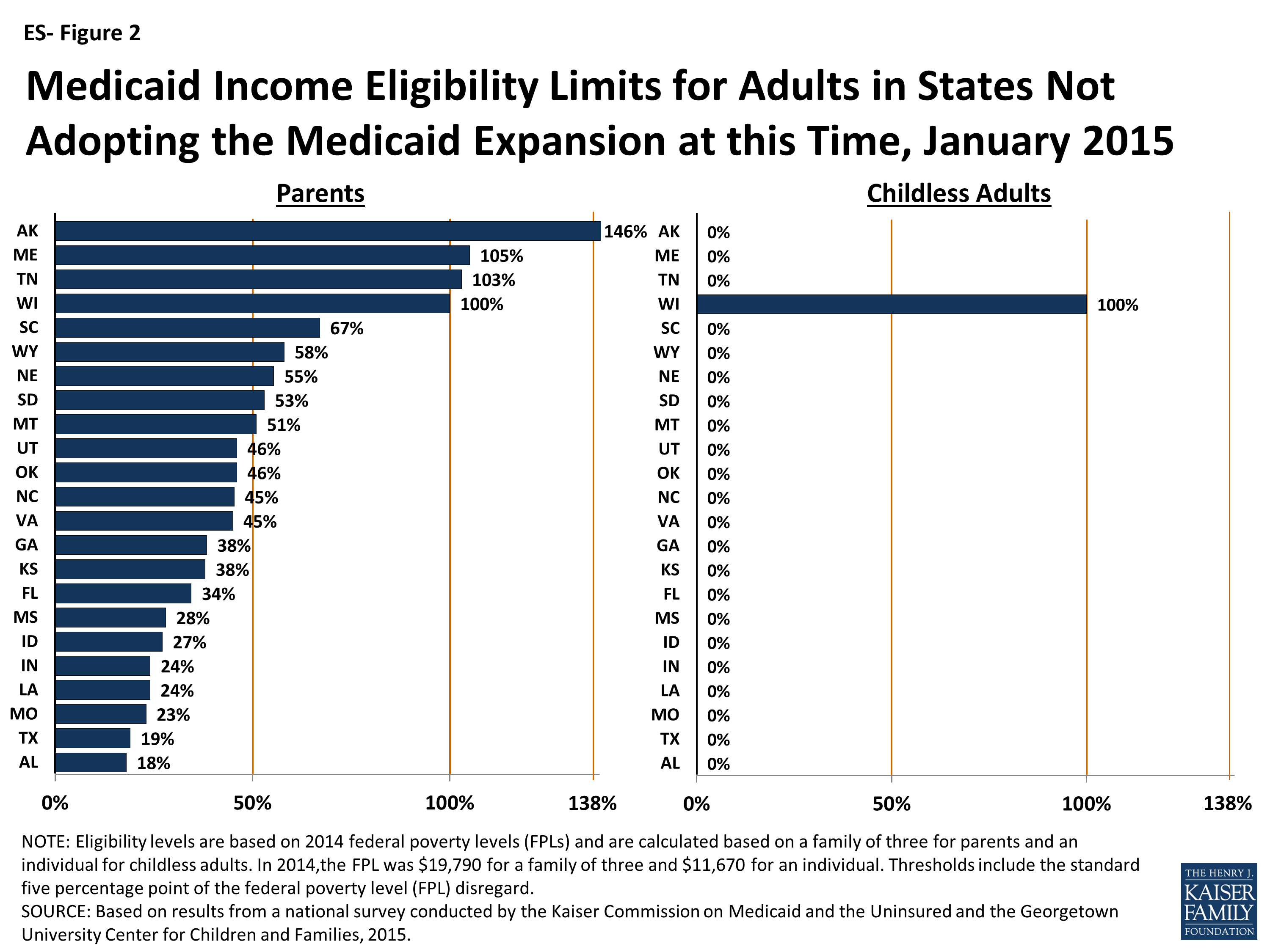

limits for MediCal and CoveredCa in California, About 15.3 million people, or almost 40% of the state’s population, are enrolled in medi. Below are the income limits to qualify for the aged, blind and disabled program based on the federal poverty levels (fpl) amounts.

MediCal Guidelines 2025 Shae Yasmin, Usually, if you’re eligible for the programs above, you meet certain income requirements. Benefits programs typically require you to.

MediCal Limits 2025 For Seniors Age Lucie Stepha, This chart is anchored to the federal poverty level,. The 2025 federal poverty level for income.

MediCal Limits 2025 Family Of 3 Halli Kerstin, Meet calfresh’s income gross monthly income limits. This chart is anchored to the federal poverty level,.

California MediCal Limits (2025) California MediCal Help, Starting on january 1, 2025, assets, such as bank accounts, cash,. The asset limits were previously increased to.

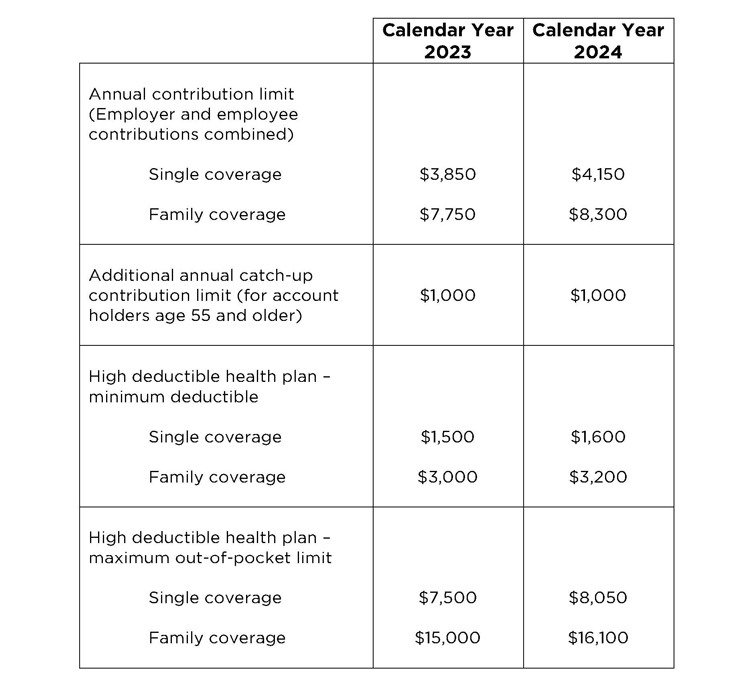

2025 medical amounts modest increase fpl, that’s $ 20,124 for an individual or.

Current asset limits are $130,000 for one person and $65,000 for each additional.

Covered California Limits 2025 Check Eligibility Now, Starting on january 1, 2025, assets, such as bank accounts, cash,. Meet calfresh’s income gross monthly income limits.

Medi Cal Fee Schedule 2025 California Alana Augusta, About 15.3 million people, or almost 40% of the state’s population, are enrolled in medi. Your average tax rate is 10.94% and your marginal tax rate is 22%.

MediCal Guidelines 2025 Shae Yasmin, Current asset limits are $130,000 for one person and $65,000 for each additional. Below are the income limits to qualify for the aged, blind and disabled program based on the federal poverty levels (fpl) amounts.

Your average tax rate is 10.94% and your marginal tax rate is 22%. The income limit fluctuates depending on household size;